How The CPFB’s Call Authentication Improves Service

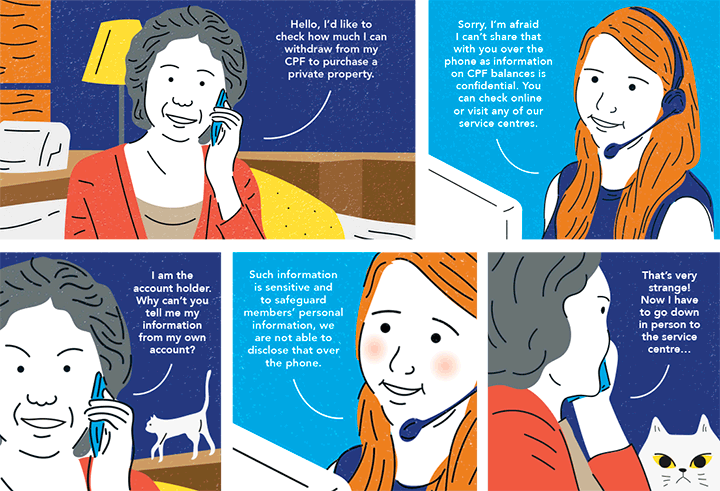

Mdm Shareen Tan, 38, was frustrated.

She had called the Central Provident Fund Board (CPFB) customer service hotline for specific information: what is the amount she can withdraw from her CPF account to purchase a private property and service the monthly instalments?

Account balances are confidential information, the officer on the other end explained, and could not be disclosed over the phone, even after Mdm Tan had completed the basic identity verification. He requested that she go online to look up her balance.

Mdm Tan’s experience is not uncommon.

Every year, more than 700,000 CPF members call CPFB for enquiries. About 36% of callers need additional guidance, which requires disclosing their personal information (e.g., CPF balances) over the phone.

But customer service executives, following confidentiality guidelines, are not allowed to reveal confidential information over the phone. So CPF members seeking customised guidance had to visit service centres or wait for hardcopy mail after sending a written request – inconvenient processes, especially for the elderly.

Ms Janice Lai, Director of the CPFB Customer Contact Centre, says: “Our customers consistently gave feedback that we could be more flexible and helpful with exact information after verification.”

Staff at the call centre also had their frustrations. They were unable to resolve CPF members’ queries at “first contact”. Over and over, they had to patiently explain that because of possible impersonation and data security issues, they could not reveal confidential information over the phone.

Was there a way that digital services could also help the less tech-savvy citizens, who prefer receiving information through traditional channels? How might CPF members get their queries addressed over the phone without compromising data security?

“Clearly, there was a need to improve the way we handle calls,” says Ms Lai. She and her team began to look into ways to transform the CPFB’s call services to resolve customers’ queries at the first instance, in one interaction, and with personalised information delivered one-to-one, according to the CPFB’s service principles.

Rethinking technology

The CPFB team first studied what other public agencies and banks did to verify identities. Many government agencies, they found, were using only single-factor authentication (1FA), such as randomised verification (e.g. customer’s home address or date of birth).

Most banks, such as Citibank, UOB and Maybank, go a step further with 2FA: using randomised verification questions and a one-time password (OTP).

In considering all their options, the CPFB decided to implement 2FA security for calls using an existing system: the SingPass.

The SingPass is a password system for many government e-services, and already uses 2FA authentication (by sending an OTP to a mobile phone or OneKey token). Could it be extended to traditional phone calls for customer service?

The team had also explored using a CPF personal identification number (PIN), but CPF members would have to create and remember yet another PIN. The idea of automated call authentication using SingPass 2FA was thus born.

There was a problem though: verifying identities over the phone with SingPass had never been done before.

A matter of persuasion

Various stakeholders needed to be convinced. The team spent months pitching their case internally to senior management and then to the Ministry of Finance (MOF), whose buy-in was critical for the project to take off.

After many rounds of discussions, the team met with the then Deputy Secretary of the MOF, Mr Ngien Hoon Ping, and sold him on the merit of using the SingPass database.

Ms Lai recalls: “Instead of asking ‘why do?’ he asked ‘why not?’ His argument for agreeing was simple – SingPass is an enabler for government e-services, and call automation for the CPF Board comes under the category of e-services.”

That was the tipping point for their project. The next level of clearance came from the Attorney-General’s Chambers (AGC), which had to address the legal considerations of using SingPass 2FA for phone calls. Lastly, the MOF had to ensure that the CPFB would not have direct access to the SingPass database, overseeing the design of the call authentication system so that it could only allow the customer service team to remotely authenticate the caller’s identity.

The CPFB’s call authentication system was implemented in January 2017. CPF members with a SingPass can call in, go through the 2FA verification process and get their queries answered on the spot.

The benefits so far

CPF members who call the CPFB can now be authenticated and receive personalised information over the phone, saving them a trip to the Service Centres. More than 99% of the customers report that they are satisfied with the new service.

Going further, the CPFB team tapped the system to automate requests for CPF statements. Once the caller’s identity is verified, the request is sent directly to the CPFB’s print and mail vendor partners. This has led to a 78% reduction in hardcopy statements and $200,000 savings annually.

Digitising such tasks frees up customer service officers from paperwork such as printing, checking and mailing the statements. “That allows my staff to focus on complex enquiries and provide guidance services,” adds Ms Lai.

The CPFB is now sharing what they have learned with other government agencies. For their efforts, the team also won the Public Sector Transformation (ExCEL Innovative Project) Award. By embracing a whole-of-government approach and using a common Service-wide system instead of creating their own call authentication platform, the CPFB has set a precedent for other agencies to use SingPass in similar ways.

Soon, Mdm Shareen Tan may be able to get more personalised guidance for various public services as easily as over the phone – with just her SingPass.

- POSTED ON

Jul 10, 2018

- TEXT BY

Radhika Puri

- ILLUSTRATION BY

Mushroomhead

.tmb-tmb450x250.jpg)