The New Currency: Going Cashless

A look at the benefits and considerations in moving towards a cashless society.

Board the bus and tap your ez-link card. Click to pay online at Zalora. Zip money to friends with mobile apps such as DBS PayLah!. Settle bills with GIRO. Use NETS FlashPay to pay for a McDonald’s meal.

Life in Singapore might seem almost entirely cashless, with so many payments going electronic. Yet consumers’ pockets are still full of coins and bills. Most people still pull out cash when they eat at hawker centres, pay the plumber or hire a tutor.

Indeed, research firm RFi Group found that almost two-thirds of Singapore consumers prefer to use cash for low-value purchases, and that only 15% of local retailers accept contactless payments through smartphones or payment cards.

.jpg)

What going cashless means

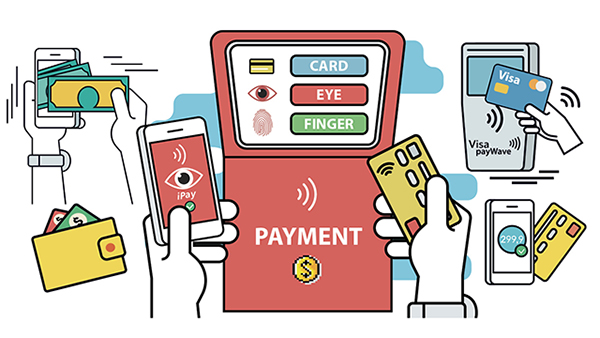

Cashless refers to making payments electronically with debit, credit or prepaid cards, ATM money transfers, mobile phones, GIRO, online or via other electronic channels; rather than with coins, bills or cheques.

Before long, though, cashless could take other forms. Monetary Authority of Singapore (MAS) Chief Fintech Officer Sopnendu Mohanty said in January at the EmTech Asia conference: “We believe that by 2020, 75% of transactions will be conducted through biometrics,” such as fingerprint, facial or voice recognition.

Looking perhaps a little further ahead, MAS Managing Director Ravi Menon said at the Global Technology Law Conference last year: “We can look to a future of seamless payments, where technology automatically recognises the customer, checks out the goods, and charges to the customer’s account as he walks out of the store.”

Roadmap to a cashless society

In preparing for that future to come, going cashless will have a major impact on how public officers plan and do their work now.

Mr Mohanty told Challenge that it is important for the government to take the lead in going cashless. “If government shifts,” Mr Mohanty explained, “people’s behaviour shifts. The Public Service has to demonstrate that we are cashless and payment is truly digital.”

Already, more government offices and businesses have begun to use electronic payments (See Hurdles On The Way To Cashless).

To promote e-payments and further reduce the use of cash, the MAS is working with the financial industry on the following initiatives:

1

Developing a unified point-of-sale terminal solution to replace the multiple terminals currently used at dining and shopping outlets, improving customer experience and enhancing integration with business systems.

2

Creating a central addressing system for citizens to pay each other through FAST, which is Singapore’s real-time retail payment system, using a mobile number, email address or social media account, without the need for a bank account number to be specified.

3

Enhancing the electronic direct debit system to allow centralised collection and billing, bringing greater convenience to both consumers and billing organisations.

Read the other stories on going cashless:

- POSTED ON

Jul 7, 2016

- TEXT BY

Richard Hartung

-

Deep Dive

Strengthening Singapore’s Food Security

-

Deep Dive

The Benefits Of Going Cashless

-

Deep Dive

In Blockchain We Trust