The Benefits Of Going Cashless

1. Saves time and money

Companies and governments can be more efficient and reduce costs by getting rid of low-value and manual work such as reconciling cash amounts. The cost of all that counting, and other work associated with handling cash, can be surprisingly high. In Ireland, for example, the government estimates that the production, administration and security for cash and cheques costs about 1.4% (€418 million, or S$940 million) of its Gross National Product.

And here in Singapore, Mr Menon said that it costs as much as S$1.50 to process each cheque, and the cost is “just as real in the transportation, collection, delivery and protection [of cash]”. Going cashless would reduce such costs. The National Council of Social Service, for example, has raised funds for the Community Chest using ez-link card readers built into MRT station posters and mobile card readers during large community events. Collecting donations electronically, instead of traditionally with tin cans, removed the need for laborious coin counting afterwards.

2. No cash equals less crime?

Businesses could avoid another cost too: cash theft that cuts into their profits. In the US, Tufts University Senior Associate Dean Bhaskar Chakravorti found that “theft risk constitutes the overwhelming majority of businesses’ costs of cash”, bleeding retailers US$40 billion annually, or nearly 1% of revenues. The cost of security measures is an additional 0.46% of revenues. People not having to handle large sums of cash likely increases public safety too. A 2014 study in the US state of Missouri found that burglary and assault dropped by nearly 10% after the government shifted payments for social welfare benefits from cash to electronic transfers, because it reduced the amount of cash available to be taken or used for illegal purposes.

In Singapore, if consumers as well as businesses, such as hawkers, no longer have to haul cash to the bank, the chances of robbery would decrease. On the other hand, in electronic payment, the incidences of fraud, identity theft and online scams can also increase. Cybersecurity measures will be needed to prevent these, while consumers must beware of potential pitfalls.

The government is a still big user of cash and cheques for receiving and disbursing payments, Mr Mohanty told Challenge.

3. Less cash equals more data

Public officers can also use the far more extensive data coming from electronic payments to analyse and improve policy. Using payments data to identify and predict patterns of commercial activity can lead to more inclusive and sustainable urban planning for housing, transportation and energy management, a research by MasterCard found.

Currently, two-thirds of workers in Singapore receive their salaries electronically, according to the Ministry of Manpower. Many foreign workers, especially in the construction and marine sectors, still prefer to be paid in cash. If their salaries are paid electronically, however, agencies could better track whether they have been paid and workers would be able to remit money home more easily.

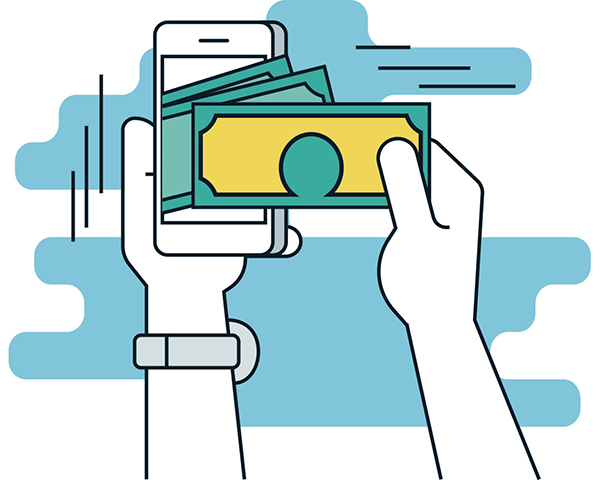

4. More spending equals economic growth

On a broader national basis, card payments boost economic growth. Higher card usage contributed about US$296 billion to consumption globally between 2011 and 2015, a 0.1% increase in global Gross Domestic Product (GDP), according to economic research group Moody’s Analytics. Shopping becomes much easier with a slew of payment options, from online with cards and through mobile phones. The convenience of cashless payments gives rise to more spontaneous buying.

In Singapore, Moody’s said that card usage added 0.1% to GDP, which would be about S$400 million per year. That extra spending also results in more jobs created, since companies need extra staff to handle the higher demand for goods and services. At the same time, the public should be made aware of the risks of debt from overspending.

Read the other stories on going cashless:

- POSTED ON

Jul 1, 2016

- TEXT BY

Richard Hartung

-

Deep Dive

Strengthening Singapore’s Food Security

-

Deep Dive

The New Currency: Going Cashless

-

Deep Dive

Hurdles On The Way To Cashless