Unprecedented Budgets To Help Singaporeans Survive And Thrive

The global pandemic produced a crisis far different from recent ones that the world has weathered.

Initially a public health crisis, the pandemic quickly evolved into a daunting economic crisis that not only shut down the world’s economy overnight but also generated supply and demand shocks.

In response, Singapore’s Ministry of Finance (MOF) rolled out five Budgets in 2020 and three Budgets in 2021. This was an unprecedented move.

Among these Budgets, the $48 billion Resilience Budget of March 2020 emerged as a landmark package in Singapore’s history. The largest of any stimulus package announced by the government, up to $17 billion was drawn from past reserves, substantially more than the $4 billion in 2008-2009 for the Global Financial Crisis.

A Need for Swift, Decisive and Pertinent Budgets

At the beginning of the pandemic, the MOF moved decisively amid rapidly evolving information.

“We knew that we could not wait for complete information in a crisis of such scale, speed and uncertainty,” says Mr Peter Lim, Director (Fiscal Policy), MOF. “Instead, we would evolve our crisis response alongside the fast-unfolding situation.

“Our key approach for the Budgets was to put a floor under the crisis – and to proceed quickly. In designing our schemes, we also made sure that we preserve capabilities to bounce back quickly later.”

This meant averting a deeper public health and economic crisis, and the Budgets did that by saving both lives and livelihoods.

“There was no trade-off between the two,” Peter explains. “To save lives, measures such as tests and vaccinations were crucial. To save livelihoods, we focused on support schemes for businesses, workers and lower-income families.”

Preventing potential longer-term economic scarring: Key initiatives under the 2020 and 2021 Budgets

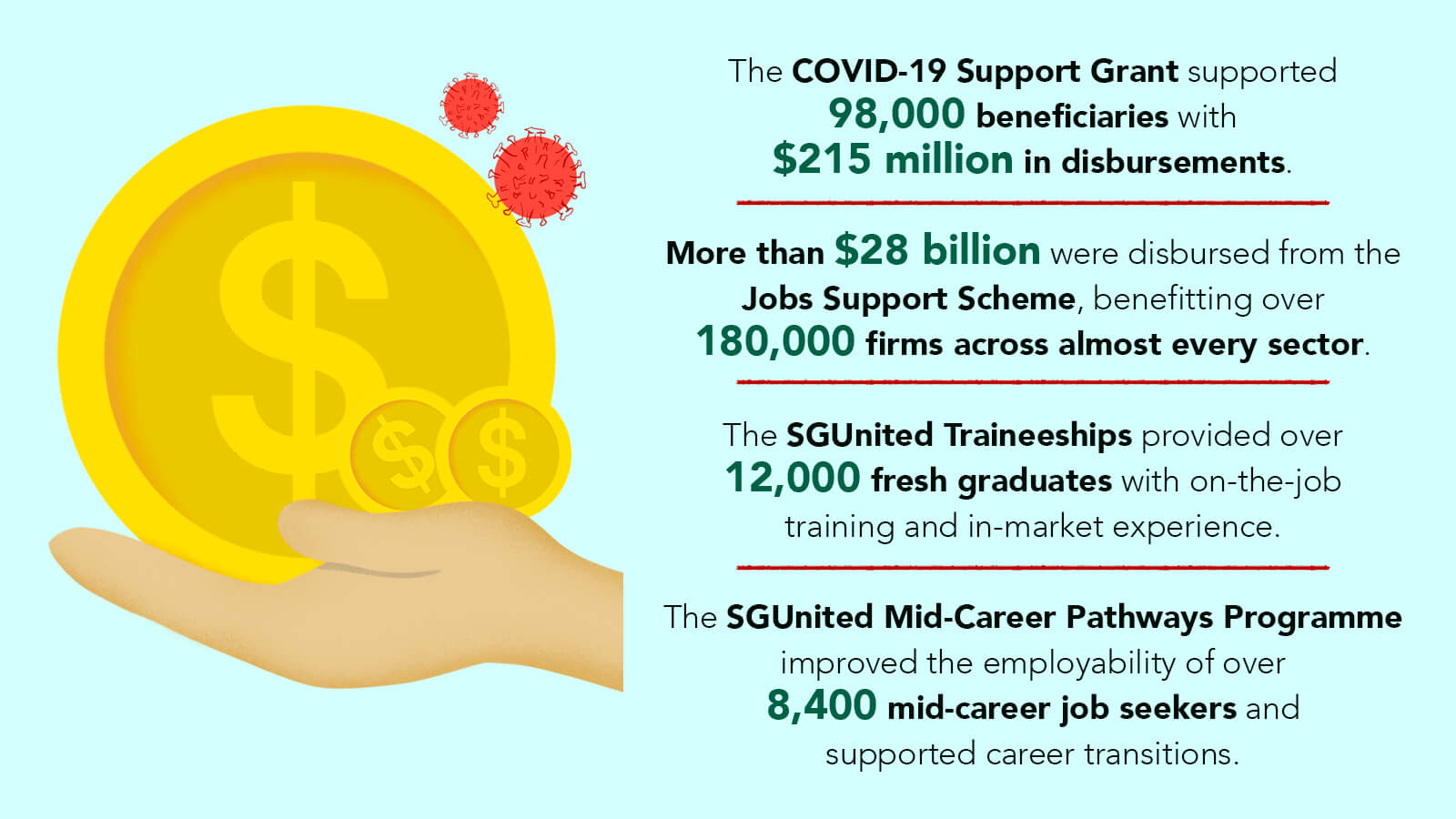

Support for lower-income groups: The COVID-19 Recovery Grant and its preceding scheme, the COVID-19 Support Grant, were among various initiatives that offered support to lower-income workers and those affected by the pandemic. The COVID-19 Support Grant supported 98,000 beneficiaries with $215 million in disbursements, and the COVID-19 Recovery Grant is ongoing till end-December 2022 to support those who continue to be impacted by COVID-19.

Helping employees stay employed: The Jobs Support Scheme helped to preserve jobs and key capabilities, in particular for smaller firms which were less likely to have sufficient buffers to tide through the crisis. More than $28 billion were disbursed from the Jobs Support Scheme, benefitting over 180,000 firms across almost every sector, with more support given to sectors that were badly hit.

As vaccination progressed around the world, we pivoted and moved towards measures to facilitate restructuring and transformation. The Jobs Growth Incentive Scheme encouraged firms to bring forward the hiring of local workers and target support at key growth sectors. These measures allowed Singapore to retain core capabilities in individuals and firms amid slower economic activity, and bounce back quickly when the global economy reopened in 2022.

Creating opportunities for job seekers: The SGUnited Traineeships provided over 12,000 fresh graduates with on-the-job training and in-market experience so that they could enter the job market during the pandemic. The SGUnited Mid-Career Pathways Programme improved the employability of over 8,400 mid-career job seekers and supported career transitions. They complemented existing place-and-train schemes we had in place before the crisis.

Supporting businesses: The Jobs Support and Wage Credit Schemes aided businesses with cash flow. Meanwhile, taxes were deferred and rental waivered. The credit schemes, together with MAS support, also ensured firms had access to credit. Different types of support were also given to hard-hit sectors such as construction, shipyard, aviation, tourism and arts and culture.

Assisting households: The Care and Support Package put cash in the hands of all families in Singapore to ease bills and household expenditures.

MOF's experience from the five Budgets in 2020 helped to shape subsequent ones in 2021 and 2022.

Peter says: “We learnt that it is important to respond decisively and swiftly, even while we tried to stay ahead of how the crisis might unfold..

“Also, the need for speed amid imperfect information necessarily meant compromises. For instance, at the start of the crisis, broad-based and timely help for workers meant less customised schemes. We gleaned useful lessons from 2020 and refined our Budgets in 2021 and 2022 to target different beneficiaries while still delivering under tight timelines.”

The Coordinated Effort of Various Agencies

The support schemes, rolled out across the health, economic and social domains, were novel and complex, requiring the MOF to work closely with various agencies as One Public Service.

Yet it was not a new modus operandi. Every Budget through the years has involved deep collaborative work among ministries and agencies to put forth a concerted plan.

“For the pandemic Budgets, we drew on the reservoirs of strong camaraderie and mutual trust and understanding forged among agencies pre-COVID-19,” says Peter.

What made their collaboration different during the pandemic was the need for rapid responses, constant monitoring and even greater cohesiveness in terms of implementation.

The Budget Implementation Committee, set up in April 2020 and jointly chaired by Permanent Secretary (Finance) Tan Ching Yee and former Second Permanent Secretary (Social and Family Development) Mr Stanley Loh addressed these needs.

More significantly, the Committee allowed the ministries and agencies to view the COVID-19 support package as a whole, rather than individual schemes, so that they could assess the overall macroeconomic impact.

Saving Livelihoods: The Jobs Support Scheme

In February 2020, the Jobs Support Scheme was launched to assist firms in their cash flow and employee retention.

As the Scheme would offer pay-outs to eligible firms across all sectors in Singapore, its planning and implementation were massive undertakings, led by the Inland Revenue Authority of Singapore (IRAS).

IRAS’ Revenue & Corporate Services Division (RCSD) and IT department worked together to develop a digitalised pay-out system that also used data analytics and risk profiling to detect fraud.

Ms Tan Puay See, Senior Enterprise Grants Officer (RCSD, Enterprise Grants Management Branch), IRAS, broadly describes how the agency approached the task: “We focused on an agile process for efficient pay-outs; tight collaboration with more than 15 agencies to ensure that various sectors were adequately supported; and safeguards to prevent abuse of the scheme.”

Ms Helen Yeo, Assistant Manager (RCSD, Revenue & Payment Management Branch), IRAS, was part of the team that developed the system. She says: “We understood the anxieties that businesses faced and prioritised timely pay-outs to help them.”

The short implementation time, manpower crunch and new challenges encountered along the way saw IRAS officers working round the clock with their counterparts from the Central Provident Fund Board and the MOF.

The agencies also had to assess thousands of appeal cases, as not all firms could be categorised neatly under conventional sectors. Between March to May 2020, the team received 600 JSS-related enquiries per day on average, and worked with the MOF and sectoral agencies to review a significant number of requests and appeals put forward by businesses.

“I’m very happy to be part of the team that has helped businesses and employees during the very trying times,” Helen says.

Puay See adds: “It has also been heartening to know that some businesses returned their pay-outs so that the support could be channelled to other areas.”

Assuring the Public of Support Available

MOF’s digital-first communications approach reduced the need for face-to-face interactions, while allowing the ministry to reach out to different segments of society and assure them that help was at hand.

Ms Farah Abdul Rahim, Communications and Engagement Director, MOF, says: “This approach included utilising social media channels; optimising information for mobile sharing; and launching online websites and tools such as SupportGoWhere, GoBusiness and the Budget Eligibility Tracker, where individuals and businesses could conveniently find out about the support catered for them.”

Pre- and post-Budgets, the MOF also held engagements with businesses, leaders and members of the public to consolidate concerns.

“By hearing directly from the ground, we could refine our support measures to better meet needs,” says Farah.

For example, the Jobs Support Scheme was expanded to include more sectors in the higher tier of support, and the eligibility criteria of the Self-Employed Person Income Relief Scheme and COVID-19 Recovery Grant were amended to benefit more people.

To align messages across the government, the MOF worked with the Ministry of Communications and Information to form a “communications nexus”, Farah says.

This nexus tapped the mass media, digital and other publicity platforms to consistently and cohesively inform the public on support schemes available as well as assurance that there is support available for those who needed it.

Eyes On The Future

The MOF published two reports to assess and account for the effectiveness of the pandemic Budgets. According to the reports, the COVID-19 support measures in the Budgets of FY2020 and FY2021 have mitigated the short-term impact of the COVID-19 crisis, and helped prevent potential longer-term economic scarring. Singapore was positioned to recover strongly.

Still, the MOF remains watchful and monitors the situation closely.

It continues to plan ahead and keep an eye on both the near- and longer-term to address key trends – such as an ageing population, climate change, technological disruption, and greater geopolitical contestation – in a fiscally responsible and sustainable manner.

Peter says: “Today, we are moving forward from a position of strength, but the post-pandemic world is fraught with uncertainties, volatilities and divisions. We have to prepare for today and tomorrow.”

- POSTED ON

Jul 6, 2022

- TEXT BY

Wong Shu Yun

- ILLUSTRATION BY

Yip Siew Fei