How US-China Trade Relations Affect Singapore

Officials from China and the US are in the midst of formal negotiations to resolve their trade dispute, which has been ongoing for more than a year.

The trade dispute started in early 2018, when US President Donald Trump first imposed tariffs on all imported solar panels and washing machines. Although these measures applied to all US trading partners with limited exceptions, the US justified these actions as protecting their economy from “unfair” Chinese trade practices.

China and some affected countries have challenged these measures at the World Trade Organization (WTO). The escalation of tensions subsequently saw both the US and China engage in a cycle of retaliatory trade actions (see timeline for more details).

To date, the US has imposed tariffs on US$250 billion of Chinese goods, while China has imposed tariffs on US$110 billion of US goods. Apart from tariffs, the US is also working on additional measures including foreign investment restrictions, which applies to China as well as other countries.

What are tariffs?

Tariffs, also known as import duties or fees, are taxes on imported goods. They are paid for by importers, and increase the price of imported goods from a particular source country. This gives an advantage to similar goods produced domestically or other import sources not affected by the tariffs.

Tariffs are used to protect a nation's industry from competition from imports, but as other countries retaliate with their own tariffs, international trade and business will be affected as goods and services become more expensive. This in turn causes people to buy less, hence reducing overall demand.

According to David Dollar and Peter Petri, both Senior Fellows (Foreign Policy) at the John L. Thornton China Center, the “rapid, wide-ranging escalation of tariffs in the US-China trade war has [had] no precedent” since the 1930s’ Great Depression.

An example of how tariffs affect global supply chains is soybean imports and exports. As China is the world’s biggest soybean importer, soybeans are the US’ most valuable export to China and worth US$14 billion (S$19 billion) annually. In retaliation to US tariffs on Chinese goods, China imposed tariffs on soybeans from the US. The resulting increase in prices has affected soybean farmers in the US, as well as feed mills in China, which use soybeans in their feed mix.

US farmers have held on to their harvests while waiting for prices to increase, or chosen to sell soybeans at lower prices than usual. Meanwhile, Chinese feed mills have looked to other sources, such as Brazil and Russia who are not affected by the tariffs, for soybeans.

Trade dispute timeline

1. January 23, 2018: The US announces worldwide tariffs on imported solar panels (30%) and washing machines (50%) to safeguard its domestic industries.

2. March 8, 2018: The US announces worldwide tariffs on imported steel (25%) and aluminium (10%) on grounds of national security.

3. March 22, 2018: The US concludes investigations into China’s purported forced technology transfers, and proposes measures to address “unfair” trade practices by China, including the use of tariffs.

4. March 23, 2018: China announces retaliatory tariffs, affecting US imports worth US$3 billion.

5. June 15, 2018: The US announces 25% tariffs on Chinese imports worth US$34 billion, with China responding on the same day by announcing 25% retaliatory tariffs on US imports of equivalent value. These tariffs came into effect on July 6, 2018.

6. August 7, 2018: The US announces 25% tariffs on additional Chinese imports worth US$16 billion. China again responded in equal measure. By the time these tariffs came into effect on August 23, China and the US had imposed 25% tariffs on US$50 billion (S$67 billion) of each other's goods.

7. September 17, 2018: The US announces 10% tariffs on additional Chinese imports worth US$200 billion. China responded with 5% to 10% retaliatory tariffs on US$60 billion worth of US imports. These tariffs came into effect on September 24, and covers nearly 50% of China’s goods exports to the US, and nearly 60% of what the US sells to China.

8. December 1, 2018: US President Donald Trump and Chinese President Xi Jinping agree to a 90-day delay on planned increases of US tariffs from 10% to 25% on US$200 billion (S$270 billion) worth of Chinese goods while carrying out bilateral talks. The increase was initially set for January 1, 2019.

9. Feb 24, 2019: Citing “substantial progress” made in trade talks with China, Trump announces that the planned increase of US tariffs on Chinese imports would be delayed further.

(Correct as of March 5, 2019)

More info:

bit.ly/PIIEtimeline

What’s behind the trade war

The US has highlighted serious concerns about its large trade deficit with China, which in 2017 was US$375 billion (S$508 billion). It perceives this to be a result of China’s “unfair” trade practices, and has been focused on addressing this issue.

For example, in a report by the White House Office of Trade and Manufacturing Policy, China was accused of expropriating US intellectual property, as well as forcing foreign companies to disclose proprietary information in order to access the Chinese market.

US Commerce Secretary Wilbur Ross said the US “is perfectly happy to compete with [China] toe-to-toe, as long as it's a level playing field," adding that what it objected to were “inappropriate methods” used to acquire more sophisticated technologies.

China has also faced criticism for placing restrictions on the extent to which foreign companies could operate and invest in China, especially in the financial and technology sectors. According to some countries, these restrictions could potentially put foreign firms at a disadvantage against their domestic competitors when they do business in China.

Made in China 2025

Trade tensions were also fuelled by US suspicions of China’s “Made in China 2025” (MIC 2025) plan. First unveiled in 2015, the plan outlines China’s strategies to upgrade its industries, increase domestic content of core components and build global champions, particularly in sectors such as artificial intelligence, new-energy vehicles and biomedicine.

However, US policymakers and security officials view MIC 2025 as an “unprecedented threat” to the US industrial base, which China denies. Chinese Vice Minister of Commerce Wang Shouwen noted that MIC 2025 provides policy guidance for China’s industrial transformations, and is similar to national guiding plans rolled out by other countries.

How this affects Singapore

China and the US are major economic partners to countries around the world. The trade conflict between the US and China, and reciprocal measures by other trading partners will have global consequences.

As a small and open economy, Singapore is highly dependent on trade. Having free and connected markets is critical. The trade tensions between the US and China will have an impact on Singapore at three levels.

The first level is the direct impact from tariffs that apply to most countries, including Singapore. The second level relates to the indirect impact, arising from disruptions to global supply chains, due to the tariffs imposed by the US and China directed at each other. The third level of impact is of greatest concern: If the trade conflict escalates, this might cause a broad-based slowdown in global trade flows, triggering a sharp and sustained fall in global business and consumer confidence.

Should this happen, global investment and consumption spending would decline, with an adverse impact on global economic growth. This would ultimately affect businesses, jobs and consumers in Singapore.

How Singapore is responding

Amidst the ongoing trade tensions, there are strengths in Singapore’s economy that serve us well.

For example, the strong trading networks and diversified sectors that Singapore has developed over the years will enable companies in Singapore to navigate disruptions, and seek out new opportunities as well as alternative suppliers and demand markets.

These external linkages are best safeguarded by a strong and well-enforced set of WTO rules, as well as a network of Free Trade Agreements (FTAs) that Singapore will continue to expand and deepen.

Beyond our traditional markets, Singapore is also pursuing closer economic ties with emerging markets to diversify our demand sources and supply chains. For instance, Singapore is looking into FTAs with the Eurasian Economic Union, the Pacific Alliance, and the Southern Common Market in South America.

Keeping Singapore prepared

Singapore will also continue to press on with efforts to help companies build the capabilities that they need to access new markets. One example is the Industry Transformation Maps (ITMs), which are dynamic plans that will be updated to help companies respond quickly to changes in the economic environment. Currently, there are ITMs for 23 sectors.

Assistance for local small and medium enterprises (SMEs) are also on hand to enhance their capabilities. Both the Enterprise Development Grant and Productivity Solutions Grant have been extended for another three years, till March 2022, to help SMEs build up capabilities to grow and transform.

Staying open to all

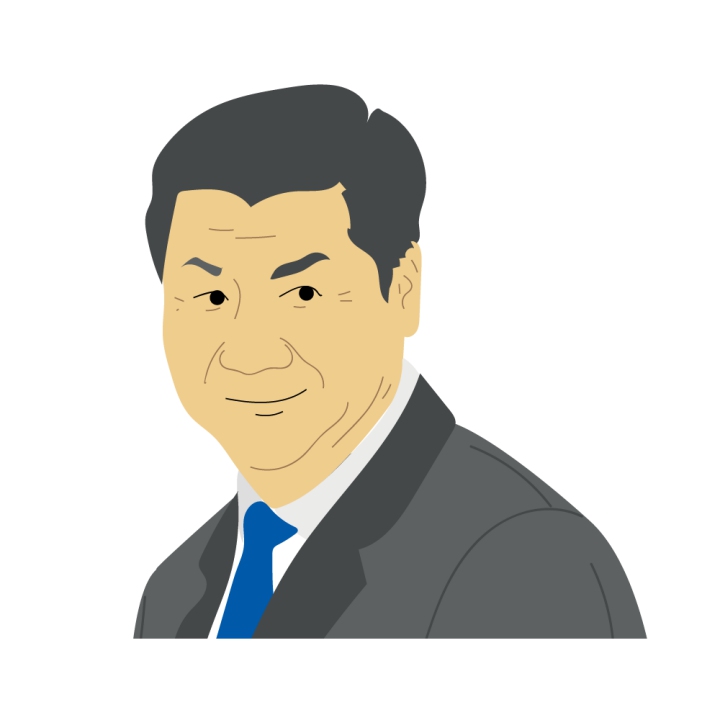

In an interview with Bloomberg in February 2019, Minister for Trade and Industry Chan Chun Sing said that Singapore is positioning itself to remain neutral to both the US and China amid mounting tensions between the world’s two largest economies.

“Our role is to keep asking ourselves how we can value-add to China and US at the same time,” Mr Chan said. “We play in a space where we want to remain neutral, remain open so that this is a place where the US, China, Europe can come, be engaged and conduct productive economic activities… that’s how we position ourselves.”

He added: “I don’t think we want to be in the position whereby we are only dealing with one and not the other, and I believe this is the same position for the rest of the Asian countries as well – everybody wants to be plugged in.”

Looking ahead, Singapore will continue to work with all like-minded partners to uphold a rules-based multilateral trading system, and work towards greater regional integration, which is the best way of maximising opportunities for companies in Singapore and supporting job creation.

To see Singapore's international trade statistics in graphics, go to: bit.ly/SStrade

Eye on Asia

For those who want to learn more about Asia and the opportunities for Singapore’s future economy, the National Library Board runs a series of talks and a bank of resources about ASEAN, China and India under its Eye on Asia initiative (www.eyeonasia.sg). The initiative is in partnership with business associations such as Business China Singapore, tertiary-level business schools and Enterprise Singapore to conduct talks. The resources also cover emerging cities.

- POSTED ON

Mar 20, 2019

- TEXT BY

Tuber

- ILLUSTRATION BY

Mushroomhead

-

Deep Dive

Strengthening Singapore’s Food Security