Financial Literacy In A Time Of Digitalisation

As more financial services become available online, Challenge explores how we can help ourselves and others improve our financial knowledge.

From digital budget planners to investment robo-advisors and online courses, there is now plenty of financial information and wealth management services available online.

In their financial lives, Singaporeans need the skills and knowledge to weigh their options in financial matters. Knowing their rights and responsibilities means they can make informed decisions about personal finances and plan well for their future.

“People who are more financially literate plan more for retirement,” University of Pennsylvania professor Olivia Mitchell said at a roundtable hosted by the Singapore Management University (SMU)’s Centre for Research on the Economics of Ageing (CREA). “They save more, invest better, and tend to space out their money over their retirement period.”

Public policy

As costs rise and the population ages in Singapore, it is increasingly important for consumers to increase their financial literacy. At the same time, digital technologies are extending the access to financial services and providing services tailored to individuals.

Robo-advisors, for example, are online platforms that use algorithms to offer investment advice and allow users to make investments directly without human investment managers. Regulated by the Monetary Authority of Singapore (but with relaxed rules to spur innovation in this space), these digital advisory services offer convenience and lower fees, appealing to young, tech-savvy working adults who may prefer a more hands-off, automated approach to investments.

As the OECD noted in a 2018 paper, the digitalisation of financial products and services, and the need to strengthen digital financial literacy, have become an important component of the global policy-making agenda.

“Policymakers should develop a national diagnosis of the impact of digital finance on individuals and entrepreneurs,” the OECD suggested.

They also need to “support the development of a national core competency framework on digital financial literacy and support effective delivery of financial education through digital and traditional means”.

Many public and private efforts to raise financial literacy aim to inform people about their choices and build communities who are more savvy about personal finance. Public policy efforts, meanwhile, may need to focus even more on digital solutions and education to make sure consumers keep up with changes and improve their financial security.

Financial literacy in Singapore

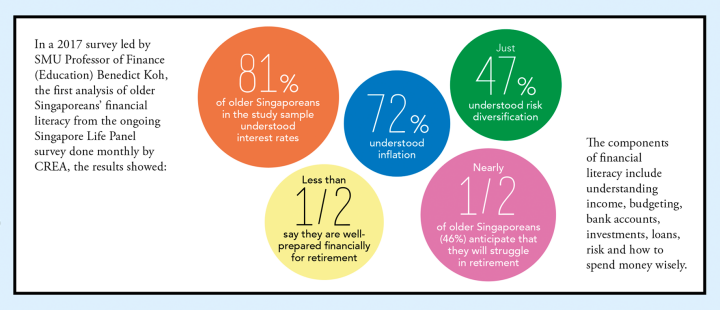

The components of financial literacy include understanding income, budgeting, bank accounts, investments, loans, risk and how to spend money wisely.

In a 2017 survey led by SMU Professor of Finance (Education) Benedict Koh, the first analysis of older Singaporeans’ financial literacy from the ongoing Singapore Life Panel survey done monthly by CREA, the results showed:

- 81% of older Singaporeans in the study sample understood interest rates

- 72% of participants understood inflation

- Just 47% of participants understood risk diversification

- Nearly half (46%) of older Singaporeans anticipate that they will struggle in retirement

- Less than half (43%) say they are well-prepared financially for retirement

On spending and saving: An OCBC survey of 866 students and young working adults aged 16-29, done earlier in 2019, show that only two-thirds managed to stick to a budget. Two out of five also struggled to stick to their saving plans.

- POSTED ON

Jun 12, 2019

- TEXT BY

Richard Hartung

- ILLUSTRATION BY

Mushroomhead

-

Deep Dive

Strengthening Singapore’s Food Security

-

Letters

Speak Up. It's Your Duty